You’ve been through the VA claims process once. It was probably frustrating and felt like a mountain of paperwork. But you might be leaving thousands of dollars on the table without even knowing it. Many veterans overlook the VA secondary claims process, and the financial impact of missed VA secondary claims can be staggering.

You are not alone if this feels overwhelming. This isn’t just about another VA form; it’s about understanding how your service-connected conditions affect your entire body. The whole VA secondary claims process the financial impact of missed VA secondary claims. Learn how to connect the dots with AMG, is about making sure you get the disability compensation you have earned.

What Is a VA Secondary Claim, Really?

Think of it like a chain reaction. Your primary service-connected disability is the first domino to fall. But that domino often knocks over others, causing new problems or making existing ones worse.

These new health issues are called secondary conditions, and filing a disability claim for them is possible. The Department of Veterans Affairs understands this can happen. This allows you to file for secondary service connections to get the disability benefits you deserve.

For example, maybe you have a service-connected knee injury from your time on active duty. Because you’ve been limping for years, you now have a bad back or a hip problem. That back or hip problem is a secondary service-connected condition to your primary knee injury.

The Financial Black Hole: True Cost of Overlooked Claims

Missing out on a secondary claim isn’t a small mistake. It can have a huge financial impact every single month. Your VA disability rating reflects your overall level of disability, and adding secondary conditions can raise that number significantly.

Let’s look at what this really means for your wallet. A higher rating means more monthly compensation. It can be the difference between struggling to pay bills and having some financial security for any disabled vet.

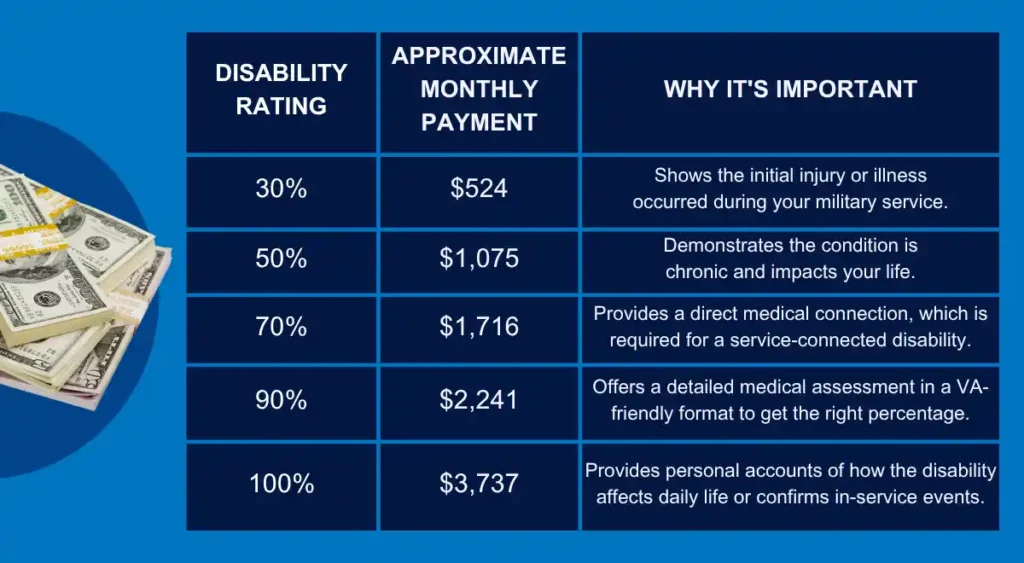

Here’s a quick breakdown of the difference a rating increase can make. These are just estimates based on VA compensation rates for a veteran with no dependents. The official rates change, so always check the current pay chart on the official VA gov website.

Look at the jump from 50% to 70%. That’s over $600 more each month. That money could cover a car payment or your grocery bill because you proved a secondary condition exists.

A higher rating can also unlock other veterans benefits. This includes better access to VA health care, educational benefits for your family, and more. Forgetting about a secondary service condition can have a ripple effect on your entire financial picture.

VA Secondary Claims Process Financial Impact of Missed VA Secondary Claims. Learn How to Connect the Dots with AMG.

Connecting your primary disability to a secondary one is the most important part of this whole process. The VA calls this connection a medical nexus. You have to prove to the VA that your new condition was caused or aggravated by your already service-connected disability.

This is where many veterans get stuck. It’s not always obvious how one condition leads to another. But this is exactly how you stop missing out on the benefits you are owed from the Veterans Affairs.

Step 1: Identify Your Possible Secondary Conditions

First, take a moment and think about your health. Since your primary service-connected condition was diagnosed, what else has come up? It helps to write everything down, even if it seems unrelated at first.

Many conditions are commonly linked. For example, veterans with PTSD often develop conditions like sleep apnea or hypertension due to stress and related factors. The connection between mental health and physical health is well-documented in many medical publications and VA publications.

Here are some other common connections:

- Diabetes Mellitus Type II can lead to peripheral neuropathy (nerve damage in feet or hands), kidney disease, or vision problems like retinopathy.

- Knee or ankle injuries can lead to chronic pain, back problems, hip issues, or arthritis in the other leg due to overcompensation.

- Traumatic Brain Injury (TBI) can result in migraines, depression, anxiety, or even hormonal imbalances.

- Sleep Apnea can be linked to weight gain caused by medications for a mental health condition, making the breathing problem worse.

- A Vietnam veteran exposed to Agent Orange might develop a primary condition like diabetes, which then leads to secondary nerve damage.

These are just a few examples that a medical provider often sees. Your own situation will be specific to you and your health history, which is why a careful review of your medical treatment history is so important. Many sister veterans face unique health challenges that can also result in secondary claims.

Step 2: Gather Your Crucial Evidence

Once you identify a potential secondary condition, you need proof to build a strong claim. The VA regional office won’t just take your word for it. You need medical evidence that draws a clear line between your primary and secondary conditions.

The single most powerful piece of evidence you can get is a nexus letter. This is a detailed report from a medical professional. In it, the doctor states that it is “at least as likely as not” that your secondary condition was caused or aggravated by your primary one.

You will also need all of your relevant medical records and any helpful doctor statements. This includes records from both a VA hospital and private doctors. Make sure these records document your diagnosis and the history of medical treatment for the secondary condition to avoid unnecessary delays.

Other evidence needed could include statements from family or friends who have witnessed how your secondary condition affects you. You can also include a personal statement explaining the connection in your own words. All of this helps the VA rater make a final decision in your favor.

Step 3: Filing the Claim the Right Way

Now it’s time to file your VA claim. You’ll typically use the same form you used for your initial disability claim, the VA Form 21-526EZ, Application for Disability Compensation and Related Compensation Benefits. It’s very important that you are clear about what you’re doing with any of the VA forms you submit.

You need to state that you are filing for a specific condition as secondary to your already established service connection. For example, “Filing for GERD as secondary to PTSD.” Being specific helps the VA rater at the local VA office understand exactly what you are claiming and why.

You should submit your nexus letter and all your supporting medical records along with your application. Submitting a fully developed claim with all the gathered evidence up front can sometimes speed up the claim process. It leaves less room for the VA to guess what you mean or request more information.

Common Missteps That Cost Veterans Thousands

Many veterans make simple, common mistakes that lead to their VA claims being denied. A denial is not the end of the road. But avoiding these errors in the first place can save you a lot of time and frustration while you navigate appeals.

One of the biggest mistakes is failing to establish that nexus we talked about. Without a clear medical link, the VA is almost certain to deny the claim. That’s why the medical nexus letter is so powerful for receiving benefits.

Another common issue is a lack of medical evidence. Some veterans think a diagnosis is enough. But you also need proof that the condition is ongoing and affects your ability to work or live your life. This ongoing documentation is critical for any disabled veteran.

Finally, some veterans simply give up after they get a denial. The VA’s system can be tough, and a denial letter can feel final. But you have the right to appeal, and many veterans, even those from Los Angeles to New York, win their claims on appeal with more evidence or a better argument to increase disability ratings.

AMG’s Role in Bridging the Gap

Trying to piece all of this together can feel like solving a complex puzzle. You have the pieces—your military records, your symptoms—but you are not sure how they fit. This is where getting help from someone who understands the system is a game changer.

Organizations like AMG have experts who focus on the veterans service. They know what the VA is looking for in a disability claim. They can help you identify potential secondary conditions you might have missed.

Most importantly, they help you build that bridge—the nexus—between your conditions. They can point you toward the right medical experts who can evaluate your situation and write a strong nexus letter. They essentially give you a roadmap for a successful claim to receive benefits.

This is not about finding a loophole. It is about presenting your case in the language the VA understands. Having an experienced guide can make all the difference and help you get the rating you deserve. Don’t hesitate to look up a phone number and get the help you need.

Conclusion

Your time in service may have ended, but its effects on your health can last a lifetime. Don’t let a confusing process stop you from getting the full benefits you earned. Understanding the VA secondary claims process financial impact of missed VA secondary claims. Learn how to connect the dots with AMG, is the first step toward getting compensation that can change your life.

Look at your service-connected disabilities again. Think about what other health problems have shown up since. Getting those conditions properly recognized with secondary service connection could be one of the most important financial decisions you make.

It’s your health and your financial future, so take the time to connect the dots. With the right help and evidence, you can secure the benefits you are rightfully owed. God bless our veterans for their service.