A low rating could mean thousands in lost compensation. Find out how to identify and challenge it. After a work injury or car accident, your doctor assigns a permanent impairment rating, but what if the insurance company’s doctor gives you a much lower one? This number plays a big role in your final settlement amount.

Many injured workers don’t realize they can challenge a rating they believe is unfair. Accepting a low number could mean leaving a significant amount of money on the table that you need for medical bills and lost wages. This guide will show you how to identify an unjust rating and fight for the maximum compensation you are entitled to.

Understanding Impairment Ratings

An impairment rating is a percentage given by a medical professional once you reach maximum medical improvement (MMI). MMI means your condition is not expected to improve further. This rating estimates the degree of permanent damage to an injured body part or your body as a whole.

Insurance companies use this percentage to calculate settlement amounts for workers’ comp and personal injury cases. A higher rating generally leads to a larger compensation settlement. The rating system is often based on the American Medical Association’s Guides to the Evaluation of Permanent Impairment.

This percentage is a critical factor in determining your final settlement payout. It directly impacts calculations for permanent partial disability benefits. Even a small difference in the rating can mean a big difference in your financial recovery.

Signs Your Rating Might Be Too Low

How do you know if your impairment rating is fair? An unfair rating from an insurance company doctor is more common than you think. Look for these red flags that indicate your rating may be inaccurate.

1. Your Symptoms Are Worse Than Described

The rating should reflect how your injuries affect your daily life and ability to work. If your pain, limitations, and struggles are more severe than the rating suggests, it’s likely too low. For example, a seemingly minor wrist injury could prevent you from typing, lifting, or performing essential job functions, impacting your earning capacity.

Similarly, a cervical spine injury might have widespread effects that are not fully captured in a brief exam. If you feel the doctor’s report minimizes your condition, you have grounds to question the rating. Your personal experience of the injury is a vital piece of evidence.

2. You Have New Medical Evidence

Strong medical evidence is the foundation of a successful challenge. New doctor’s notes, updated medical records, or results from recent tests like an MRI can provide a more accurate picture of your condition. A specialist’s opinion that contradicts the initial rating can be particularly powerful.

Your doctor’s recommendations for ongoing or future medical care can also support a higher rating. This shows that your injury requires more extensive management than the rating implies. Always keep detailed records of your medical treatment and expenses.

3. Your Condition Has Worsened

Some injuries, especially head injuries, get worse over time. A traumatic brain injury might initially seem manageable, but cognitive issues like memory loss can develop or intensify later. If your condition has deteriorated since you received the rating, you have a strong case for a re-evaluation.

This is also true for physical injuries that develop complications. Document any new symptoms or limitations and discuss them with your treating physician. A worsening condition proves the initial permanent impairment rating was not accurate.

4. The Doctor Was Hired by the Insurance Company

Insurance companies often require you to see a doctor they choose for an “Independent Medical Examination” (IME). These doctors may have a financial incentive to provide lower ratings to help the insurance company save money. If the IME doctor’s opinion differs greatly from your own doctor’s, it’s a major red flag.

You have the right to get a second opinion from a physician you trust. A contrasting report from your doctor is a key piece of evidence in challenging the insurer’s low rating. Never assume the insurance company’s doctor has your best interests at heart.

How to Challenge a Low Rating

Challenging a low rating is essential to securing a fair comp settlement. The process requires careful preparation and strategic action. Follow these steps to build your case and fight back against an unfair assessment.

1. Review the Rating Report

Start by carefully reading the entire medical report that assigned the impairment rating. Look for any inaccuracies, omissions, or statements that downplay your symptoms. Check if the doctor considered all your medical records and documented injuries, especially if you suffered multiple injuries.

2. Gather Your Evidence

Collect all relevant medical evidence that supports your position. This includes your complete medical history, notes from every doctor visit, physical therapy records, and diagnostic test results. Statements from your own doctors about how the workplace injury affects your ability to function are extremely valuable.

Lay evidence from family, friends, or coworkers can also help. These statements can describe the impact of the injury on your daily life, something a medical report might not fully capture. A strong case is built on comprehensive and compelling evidence.

3. Get an Independent Evaluation

The most effective way to counter a low rating is with a higher rating from another doctor. Ask your treating physician to perform their own impairment rating assessment. Alternatively, a workers’ comp lawyer can help you find a neutral, respected doctor to provide an unbiased evaluation.

4. Consult with an Injury Law Attorney

A comp lawyer can make a significant difference in your compensation case. An experienced attorney understands how to dispute low ratings and negotiate with insurance companies. They can file the necessary paperwork, write a persuasive demand letter, and represent you in any hearings.

Legal support ensures you don’t make critical mistakes that could harm your claim. An attorney from a reputable law firm will work to build a strong case for the maximum compensation you deserve. Feel free to schedule a consultation to discuss your injury case.

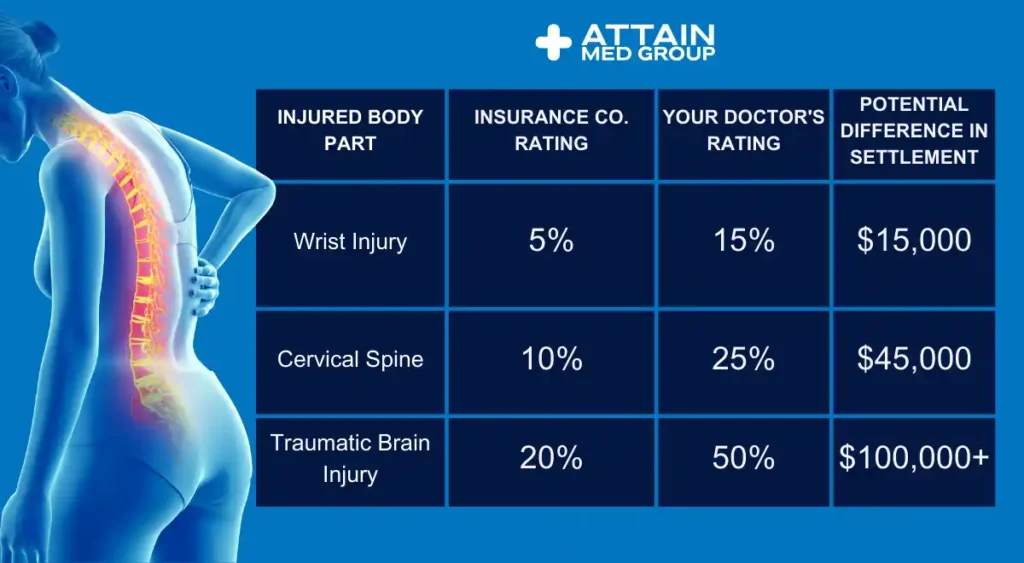

Below is a table showing how different ratings can dramatically affect settlement values for a permanent partial disability benefit, based on a hypothetical state system.

Common Mistakes to Avoid

The process of challenging a rating is filled with potential pitfalls. Avoid these common errors to protect your claim. A simple mistake can delay your case or even result in a denial.

- Missing Deadlines: States have strict time limits for disputing a workers’ comp decision. Missing a deadline can prevent you from ever challenging the rating.

- Accepting a Settlement Too Soon: Do not accept a lump sum settlement offer based on a low rating. Once you accept, you generally cannot ask for more money, even if your condition worsens.

- Not Getting a Second Opinion: Relying solely on the insurance company’s doctor is a mistake. Always get an evaluation from a physician who is on your side.

- Poor Documentation: Failing to document your symptoms, limitations, and how the work injury affects your life weakens your case. Keep a detailed journal.

- Giving a Recorded Statement Alone: Insurance adjusters may ask for a recorded statement to find information they can use against you. It is best to have a workers’ comp lawyer present.

- Exaggerating Symptoms: Be honest about your condition. Exaggerating can damage your credibility and harm your entire compensation case.

- Not Waiting for MMI: Do not agree to an impairment rating until you reach maximum medical improvement. Your condition may not be stable yet, and a premature rating will likely be too low.

Getting Help with Your Appeal

You do not have to challenge a low rating alone. A law firm specializing in workers’ compensation can provide the legal support you need.

A comp lawyer helps by analyzing your medical records, arranging for an independent medical evaluation, and negotiating with the insurance company. They understand how ratings play a big role in settlement calculations and will work to ensure your impairment rating is fair. Most injury law firms work on a contingency fee basis, meaning they only get paid if you win your case.

What to Expect During the Appeal Process

Challenging an impairment rating takes time and patience. The first step is typically an informal negotiation between your attorney and the insurance adjuster. If that fails, your case may proceed to a more formal process.

This could involve mediation, where a neutral third party helps you and the insurer reach an agreement. If no agreement is reached, your comp case might go to a hearing before a workers’ compensation judge. Throughout this process, your lawyer will present the medical evidence and argue for a higher rating.

The entire appeal can take several months to over a year, depending on the specifics of your case.

Real-Life Examples of Challenged Ratings

Many injured workers have successfully challenged low ratings and secured fair settlements. For instance, a construction worker suffered multiple injuries, including to his back and shoulder, in a fall. The insurance doctor gave him a 15% partial disability rating.

His attorney helped him get an independent evaluation, which resulted in a 40% rating that more accurately reflected his inability to return to his physically demanding job. This change led to a comp settlement that was nearly three times the initial settlement offer. This shows how a successful challenge can make a big difference.

Another case involved an office worker who developed a severe wrist injury from repetitive motion. The initial rating was only 5%, which offered a very small settlement payout. After presenting evidence of her chronic pain and need for future medical care, including potential surgery, her rating was increased to 20%, ensuring her long-term needs were covered.

Conclusion

A low rating could mean thousands in lost compensation. Find out how to identify and challenge it, because your financial stability after a workplace injury depends on a fair assessment. Do not simply accept the number the insurance company gives you, especially if you feel it doesn’t reflect your reality.

Review your rating carefully, gather strong medical evidence, and consider getting a second opinion. Remember, challenging a low rating is your right. It is a critical step toward securing the full settlement you need to cover your medical expenses and lost earning capacity.

The process can be difficult, but with persistence and professional legal support, you can fight for a rating that truly represents your permanent impairment. Your health and well-being deserve a fair and just compensation settlement. Don’t let an insurance company decide your future.